The Impact of Changing Mortgage Rates on the UK Housing Market

The UK housing market has always been a topic of interest due to its fluctuating nature and significant impact on the economy. Recently, the spotlight has turned to the changing mortgage rates, a critical factor influencing the market's dynamics and buyer behaviour. As mortgage rates begin to stabilise after a period of volatility, it is crucial to examine how these financial conditions are reshaping the property landscape, particularly in terms of buyer affordability and market activity.

Recent Trends in Mortgage Rates

In the past year, the UK has witnessed a noticeable fluctuation in mortgage rates. After a period of historically low rates, there has been a sharp increase, aligning more closely with global economic trends. According to Rightmove, these changes are expected to have lasting effects on the housing market into 2024. The Guardian also highlights that these increases are part of why house prices fell for the first time in six months, marking a shift that could suggest a new trend in the housing market dynamics.

Impact on Buyer Behavior

The volatility of mortgage rates significantly impacts buyer behaviour. As rates increase, the cost of borrowing becomes higher, which can deter potential buyers, especially first-timers, from entering the market. This leads to a greater interest in renting rather than buying as a more affordable short-term option. The psychological impact of rising rates can also not be underestimated; the uncertainty it breeds may lead buyers to postpone their purchasing decisions in hopes of more favourable rates in the future.

Housing Market Dynamics

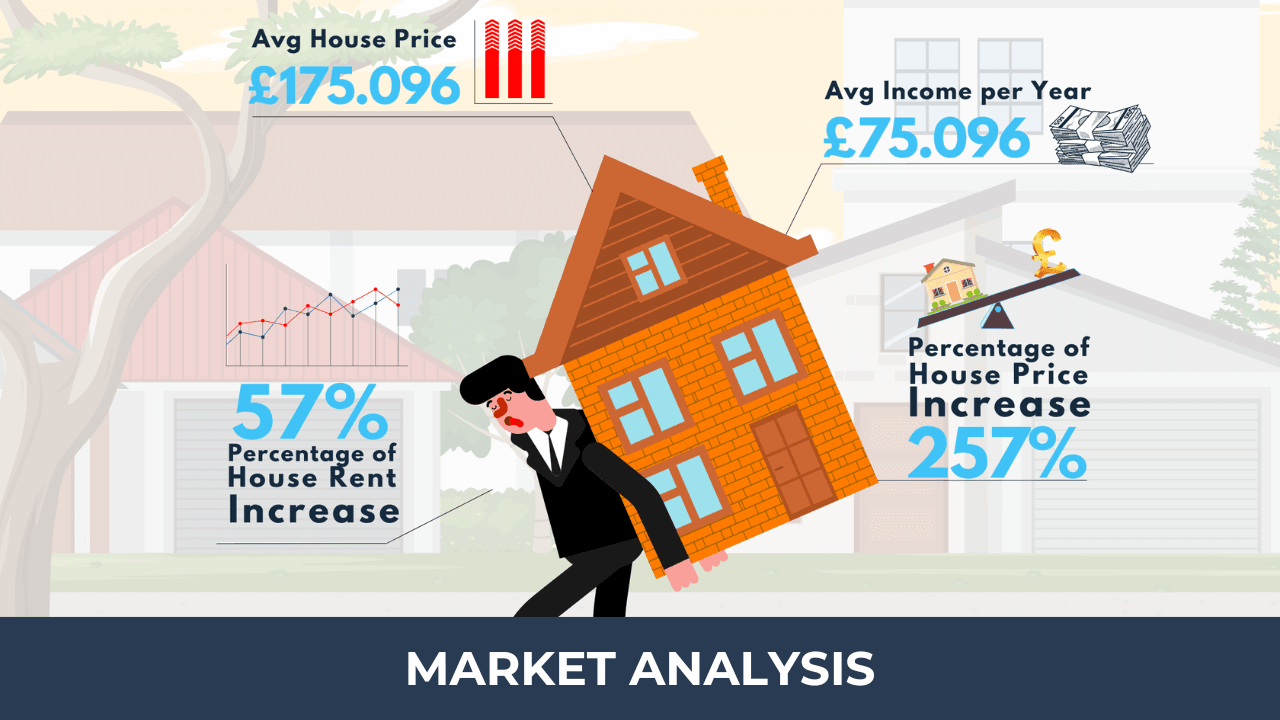

The interplay of supply and demand significantly shifts with changes in mortgage rates. Higher rates generally lead to a decrease in demand, as fewer buyers can afford the higher monthly payments. This change can lead to an increase in housing inventory levels, causing homes to remain on the market for longer periods. Consequently, sellers may be forced to lower their prices to attract buyers, which can stabilise or even decrease home values across regions. This dynamic varies widely across the UK, with some areas seeing more pronounced effects than others.

Future Outlook and Stabilization of Mortgage Rates

Looking ahead, experts like those from Rightmove predict that mortgage rates may stabilise, but at a higher baseline than in previous years. This stabilisation is likely to influence the housing market by setting new norms for buyer affordability and home values. If rates stabilise at these higher levels, the market could see a gradual adjustment in buyer demographics, with potentially fewer first-time buyers and more investment-driven purchases. Such shifts will be crucial for stakeholders to monitor as they plan for the future.

The changing mortgage rates are reshaping the UK housing market in profound ways. These fluctuations influence not only the affordability and accessibility of housing but also the strategic decisions of buyers and sellers. As we look to the future, understanding these trends will be crucial for anyone involved in the property market. Keeping an eye on these changes can help predict further shifts and prepare for the evolving landscape of the UK housing market.